By Disaster or Design

A post-growth world is coming.

Yesterday, Arketa Institute for Post-Growth Finance (where I work) launched our report - By Disaster or Design. The report is meant to educate financial and sustainability professionals, and anyone who is interested on Ecological Economics and degrowth. In the report we describe how Ecological Economics should replace Neoclassical Economics because the latter is better at taking into account the materials needed to run a world and the waste that such running of the world takes. We introduce degrowth as a path we think the world should take to get to a post-growth economy.

We talk about the implications for finance, which will be many. We see the size of the financial world shrinking, and focused on more local issues and the regeneration of Earth’s natural system that have been diminished.

We end the paper by talking about how these changes, which are needed will be a huge change in culture and our own identities, and the stories we tell ourselves.

I’m attaching the Executive summary of the report below, so you can sound like you read the whole thing, if you have friends that would be impressed by that. If interested, please read the whole report and share it with anyone you think might benefit from learning about degrowth.

The current state of the world demands that finance evolves … and quickly.

The economic and financial systems we have today are not fit for purpose if that purpose is human wellbeing. The economic and financial system we have today is fit for the purpose of creating and accumulating wealth. Unfortunately, that process as currently practiced is destructive to human wellbeing, and at an accelerating rate.

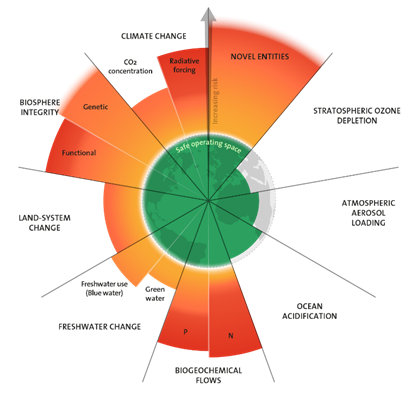

We have pushed past six of nine planetary boundaries, meaning we live outside of a safe space for humanity in these areas.

These planetary boundaries represent the natural systems that make up our life support system. We as a global civilization have decided that growth as measured by GDP growth is how we measure success. This outlook is shortsighted at best, but self-destructive in the long term.

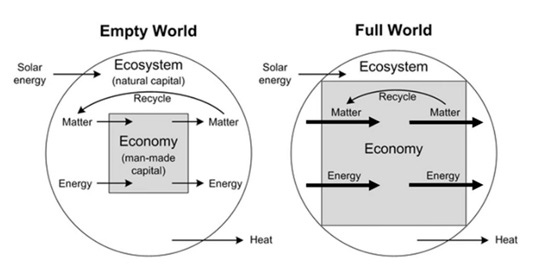

The fundamental flaw of Neoclassical Economics that drives our financial system is that it does not adequately account for the energy and materials we use to drive our global economy. Neoclassical Economics takes note of certain parts of the production and consumption processes but does not adequately account for the material moving through the process or the energy needed at every stage. It also ignores the larger system in which all this activity takes place—the environment—which is the life support system upon which our lives and economies depend. Neoclassical Economics suggests that an economy can grow more and more profitable and prosperous forever.

We recommend a movement toward a more “complete” economics - Ecological Economics, which reminds us that the economy lies within society, and that both the economy and society sit within and depend upon our environment.

Ecological Economics recognizes that an economy that grows forever simply is not possible on a finite planet and shifts the focus instead to ask what the optimal scale of the economy might be.

When an economy is very small relative to the biosphere, the biosphere can easily provide all the resources for the economy and easily deal with the waste produced by the economy. Such a state in which the economy is very small in relation to the biosphere is an “empty world” in the language of Ecological Economics. For most of human history, we lived in an empty world in which our actions did not materially impact the biosphere. But we do not live in an empty world anymore.

We live in a “full world”, where the economy is bumping up against, and even surpassing the limits of what the biosphere can sufficiently handle.

Technology can help us, but it cannot save us. “Green growth” has been promised as a solution to our environmental problems, often because it does not call for a radical rethinking of our economic models. But “green growth” can only get us so far. Growth that is “green” still requires massive uses of energy and materials that just shifts the problem to other industries or other locals and does not adequately address the need to return to the safe zone of an economy operating within planetary boundaries.

Taking a degrowth path to an ultimate post-growth economy that focuses on environmental integrity and human well-being over economic growth is needed. This is not a political statement, but one that recognizes that we live in a full world that cannot support humanity much longer without a scaling back of our energy and material use. If we lived in an empty world, our energy use and materials use would not be a problem. But we do not live in that world.

Degrowth is not austerity, and is not a call to punish wealth, but a call for humanity to stop confusing its wants for its needs, when those wants are destructive to our life support system.

Finance needs to evolve.

Our current financial and economic systems are built on the expectation of perpetual growth. Even a modest expectation of two percent growth globally means that the global economy would double in thirty-five years. That mandate for growth is incompatible with a world in which we must move back to the safe side of our planetary boundaries.

Sustainable investing as it is currently practiced only incrementally addresses these problems. Currently, sustainable investment means choosing from a menu of investments, some of which are already not compatible with staying within planetary boundaries. Such action will not result in sustainable outcomes.

The menu of investments to choose from must be compatible with planetary boundaries from the start. This will push some current business models off the menu if we wish to stay within planetary boundaries.

The logical conclusion is to put the integrity of our planetary boundaries first and foremost in our economic, political and cultural decision making, as these planetary systems are our life support system. If we choose not to do so, disaster will eventually force us back within them, as Earth’s systems break down.

The financial sector needs to evolve to accommodate a system focused on well-being and not economic growth. This will mean a decline in the “financialization” of the global economy and a return to a more traditional role for finance of financing smaller and community focused initiatives that operate withing planetary boundaries.

We recommend five principles to guide finance to a post-growth compatible financial system:

A shared foundational goal: wealth as wellbeing within planetary boundaries

Bring finance back down to earth, invest in real economy degrowth

Become more transparent

Be more democratic

From “too big to fail” to “small enough to be resilient” (be smaller and more local)

Finding a new path.

By recognizing the limits of our planet and accepting physical reality, we can better prepare for a post-growth economy. We can lay the foundations for a society that can thrive within our planetary budget and move towards an economy where growth will happen but is no longer a measure of economic success.

Some of our peers are already adopting this mindset. Examples of institutions adopting this post-growth model include Triodos Bank in the Netherlands, or Alternative Bank Schweiz based in Switzerland. Each bank looks to serve local community needs while operating within ecological limits. Other financial firms can develop their own models that prioritize serving client needs within planetary boundaries.

This will take a change in not only finance, but in politics, culture, and importantly in our own identities. The way we do business and the way we live our lives is ingrained in a growth at all costs mindset. But that “cost” is the very systems that keep us alive.

Finance can follow this new path. We believe it must.

I am half way through this EXCELLENT white paper … and it is good. Really, really GOOD. It's not the shallow, hastily researched content that is sadly becoming too frequent in our world. This is careful, thoughtful, educated, and brave.

https://www.arketa-institute.org/resources/by-disaster-or-design

Excellent paper and so important to get these ideas out there, help more people understand them and start to really implement them. Matt, thanks again for coming on The Future of Finance podcast to talk about this paper and the ideas it explores -- I encourage others to check out our conversation - https://thefutureoffinance.podbean.com/e/beyond-growth-rethinking-finance-in-a-full-world-with-matt-orsagh/