Q: What Happens When Insurance Fails?

A: Everything Else Does Too.

Homeowner’s insurance in Florida - which rises faster? The water or the premiums?

Florida coastline today vs. projected coastline 2050 - 25 years from now.

Source: The World in 2050 by Laurence C. Smith

Insurance is an interesting concept. We couldn’t have insurance until we started organizing into societies. Sure, there might have been some ancient “protection racket" whereby if your tribe was bigger and stronger than others, you would either protect them or not kill them for some kind of fee or trade. But what I’m thinking about for the sake of this essay is the kind of insurance we think about today. Collective pooling of resources in the case that a “low probability event” occurs.

Here’s a bit of a primer on the History of Insurance.

Babylon (circa 4000–3000 BCE): Merchants used bottomry contracts, where loans for shipping ventures were only repaid if the voyage succeeded. Sounds like risk sharing or insurance to me.

Code of Hammurabi (circa 1750 BCE): This legal code formalized bottomry, allowing cargo to be pledged against loans, with repayment waived if the ship was lost.

Ancient Greece and Rome: Greeks practiced marine insurance, and Romans had burial societies that covered funeral costs through member dues. I wrote about a year ago in an essay on solidarity about the Romans originating the idea of debts held in common. This was an early form of insurance in a way. Farmers would hold debt together for example and could help each other. When one farmer's crops failed, another could support him who had a bumper crop year.

Guild Systems (Middle Ages): Craftsmen paid into guild funds that acted like insurance. If a member’s shop burned down or they were robbed, the guild covered their losses.

Lloyd’s of London (1600s): Originated as a coffeehouse where merchants and underwriters met to insure ships. It became a formal institution in 1769 and remains a major player in global insurance today.

18th–19th Century: Life insurance became more widespread with the development of mortality tables.

Today: Insurance spans health, auto, property, liability, and more, forming a cornerstone of financial planning and risk management.

Insurance works until it doesn’t.

Insurance is quite a nifty little thing. It works if there is a low probability event (death, auto accident, health problem, dental issue, pet issue, etc.) You can insure almost anything if you are willing to pay the price. Movie stars have insured their body parts, sports clubs take out insurance on the health of their players. You can even buy alien abduction insurance (mainly a humorous novelty gift).

The linchpin that holds all insurance together is that phrase “low probability event”. Insurance is there to help us if something unlikely happens, like our house burning down, we get a rare disease, or if we suffer an untimely death. We can rebuild our home, treat the disease, and provide for our families if we suffer a fatality early in life. Life insurance is relatively cheap if you are 25 and healthy, but your options will be limited and premiums very high if you are looking to take out a policy ass a 90 year old.

But what happens when “low probability events” become not so low probability?

The answer is that your insurance company will stop insuring that not so low probability. They are a business, not a charity. Insurance, more than any other industry, is in the reality business. Companies and politicians can spin, obfuscate, mislead or shade the truth through either PR, advertising or flat out lying, but insurance companies can’t do that. The math tells them the likelihood of an event, and they have to adjust what they charge.

You can argue that the canary in the coal mine is long dead and the insurance industry has not done a good job of warning on climate change, overshoot and ecological collapse, but they are starting to sound the alarm.

They said it on TV, so it must be real.

Gunther Thallinger, a board member of Alliianz one of the world’s largest insurers said in a post published in late March, that entire asset classes were "degrading in real time" as extreme weather events take their toll. He warned the worsening climate crisis appears to be on track to destroy capitalism. (You can cheer if you like, but I’m not).

In a separate interview, Thallinger, told CNBC that approximately two-thirds of economic losses from natural catastrophes are currently uninsured, indicating a "major societal problem." He also said that the climate crisis could make adaptation “economically unviable."

Here are a few more quotes from Thallinger’s interview:

"If this volume just grows even more, we simply have a societal situation that is not bearable anymore because it is just too much risk that is no longer covered."

“But the technologies we have that are here now or in the process of being commercialized can cut emissions 80% to 90% or more by mid-century."

I appreciate Thallinger’s candor, but I don’t know where he is getting that nonsense about 80 - 90% cut to emissions by mid-century. Theoretically possible? Yes. Politically possible? No. So don’t go any further down that path.

He’s a board member at an insurance company. He is walking a very delicate tightrope. He doesn’t want to panic people by saying that the insurance industry is fucked, and if that is the case then everyone is fucked. I don’t think I have to read between the lines when he says that the climate crisis could make adaptation economically unviable. Economically unviable sounds like a board member saying “you are fucked” when he knows he can’t say “you are fucked”, but very much wants to say, “you are fucked”.

What does that mean?

That means that any asset that could be insured in the past and will not be insured in the future is a depreciating asset.

Because it is germane to this conversation, I’m posting a bit of an essay I wrote last October about Florida, and its future in America’s Hurricane Alley. Homeowners insurance is expensive in Florida and it is only going to get more expensive. Florida’s homeowner’s insurance rates are four times the national average. None of the big national homeowner insurance companies in the U.S. have much of a presence in Florida. In July of 2023, Farmers Insurance announced it would stop offering its policies in Florida including home, auto, and umbrella policies, citing increased hurricane risks. Before this announcement, Farmers Insurance covered about 100,000 Floridians.

Most homeowners in Florida now get their insurance from local insurance companies, many of which don’t have the resources of their larger national competitors to absorb what will become ever-increasing liabilities in the state because of climate change. The state offers Citizens Property Insurance Corp. as the last resort insurer in Florida. In the wake of Helene and Milton, there are concerns that Citizens Property Insurance Corp. may become insolvent if they have to pay out too many claims. But Citizens is not structured like a normal insurance company. If things get really bad, Citizens is permitted by the state of Florida to add a surcharge to the bills of its policyholders. So Citizens won’t go insolvent, it will just charge the people of Florida more and more as storm damage gets worse and worse. That does not sound like a sustainable model for the good people of Florida.

A 2024 report by S&P Global Market Intelligence showed that climate risks could cost global real estate up to $559 billion, or 28% of its value—by 2050.

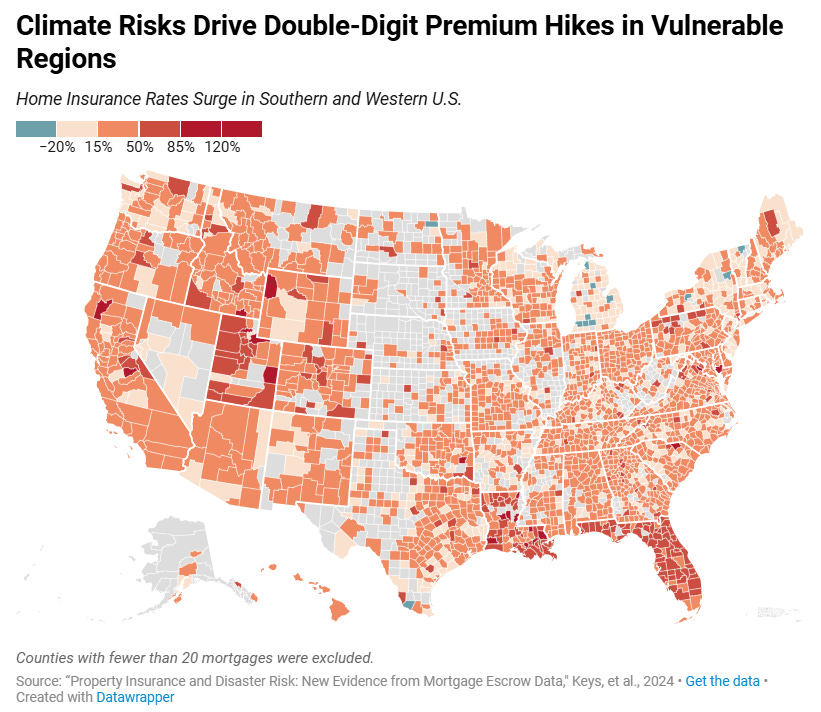

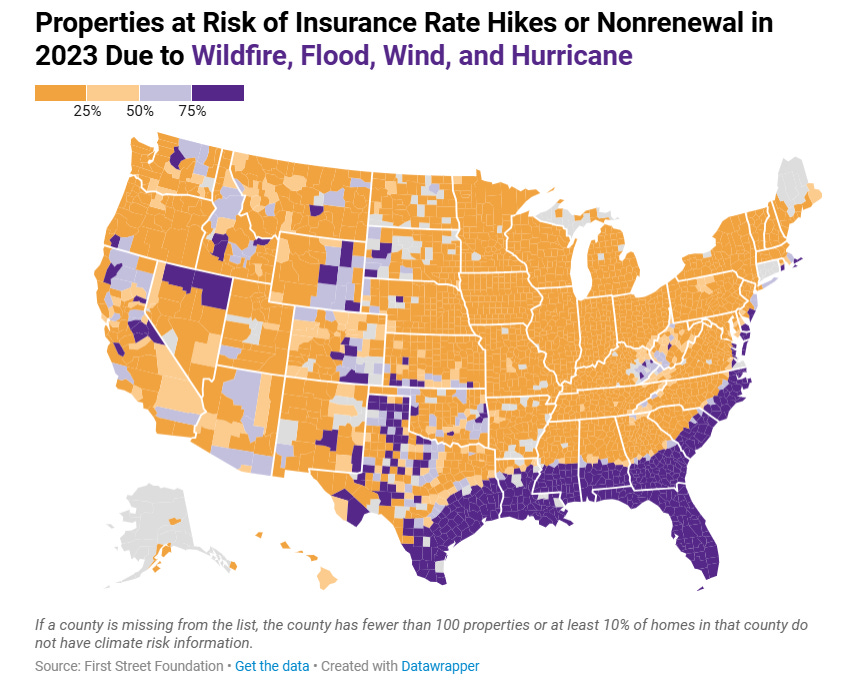

From 2020 to 2023, insurance premiums in the US increased by 33%. The price of reinsurance (the insurance for insurers) nearly doubled between 2018 and 2023. That cost is passed on the homeowners.

Take a look at the maps below. Looks like we all need to move to the Upper Midwest and away from the Southeast.

At some point homeowners will realize that they can’t afford insurance anymore and will “roll the dice”. Most people’s houses will of course be fine, as damage will still be a lower probability event. But the probability will be higher than before, so more people will need insurance - while less will have it. That is not a recipe for a happy and healthy society. I can imagine a not-too distant future where a category 5 hurricane hits Florida, causing trillions of dollars of damage. But because they couldn’t afford insurance, many people will have no insurance to rebuild, and the state and federal government will either have to pick up the bill - angering the rest of the taxpayers of the country who will pay to bail Florida out, or will simply have to say, “we recommend you don’t live there anymore”.

That may be the exogenous event that gets the collapse started. What do you think? Is the inevitability of insurance companies refusing to insure the lives we are used to living be the straw that breaks the camel's back, making people finally take collapse seriously, or will it be something else?

Insurance is a huge topic in its role in collapse. Talking about homeowners insurance is a good place to start. It's been on mind, too, and plays a role in every aspect of society. Farm insurance is also on my mind. It's tough to contemplate losing our homes in an uninsured event, but farmers unable to afford insurance has obvious and dire implications for everyone. Perhaps you would like to investigate that? Thanks for a good article on an important subject.

I love insurance. It doesn't care about the nut jobs running the country or making decisions about things. It's just cold hard analysis of the facts. It tells the story. Very simply.