The AI Bubble

It's going to pop soon.

Photo by Jacky Zhao on Unsplash

In the late 1990s I was in grad school getting a business degree. For one of my classes our professor had us play the “stock market game” in which we all got fictitious accounts of $10,000 to invest over the semester. We could buy any stocks we wanted.

This was during the height of the dot.com bubble, but we of course did not know that at the time. It was hard NOT to double your money in the four months that the contest ran. You weren’t allowed to use leverage (using borrowed money to goose your returns), but most everyone in the class did fabulously well, I think I ended up with a fictional portfolio of about $22,000 by the end of the class. It was a long time ago, so I don’t remember the exact numbers. But I do remember that at the end of the class we had all learned that the stock market was a casino where it was very easy to win. Our professor, who had much more life and market experience than all of the students in his class, cautioned us that the stock market doesn’t usually work that way and that what we saw during four months of fake investing was not what we should expect in the future.

Luckily, I didn’t have much money to invest at the time, so I couldn’t have ignored his advice even if I wanted to.

Market manias, booms and busts have happened throughout history, from the tulip bulb mania of the 1600s in the Netherlands, or the housing bubble that led to the 2008 financial crisis. Most societies are suckers for easy money as the momentum grows behind such a mania, and they see their friends and neighbors getting richer. Greed and envy kick in, and the bubble grows until gravity sets in.

We are in a bubble with Artificial Intelligence (AI) stocks. But the AI bubble we are in now is no different.

The AI bubble will burst, and just like other bubbles there will be a lot of pain on the other side. This bubble is happening at a time when we have pushed past ecological planetary boundaries, and the level of inequality in the world is at unprecedented levels. That means the crisis that will come with the bubble popping will just be one of a few monumental problems. Do we have leadership that can navigate those turbulent waters?

(I can hear you laughing and crying).

There will be a crash, and there will be an attempt to bail out those responsible at the cost of those not responsible.

But there may not be an appetite for such a bailout this time.

The 99% 2.0 is coming.

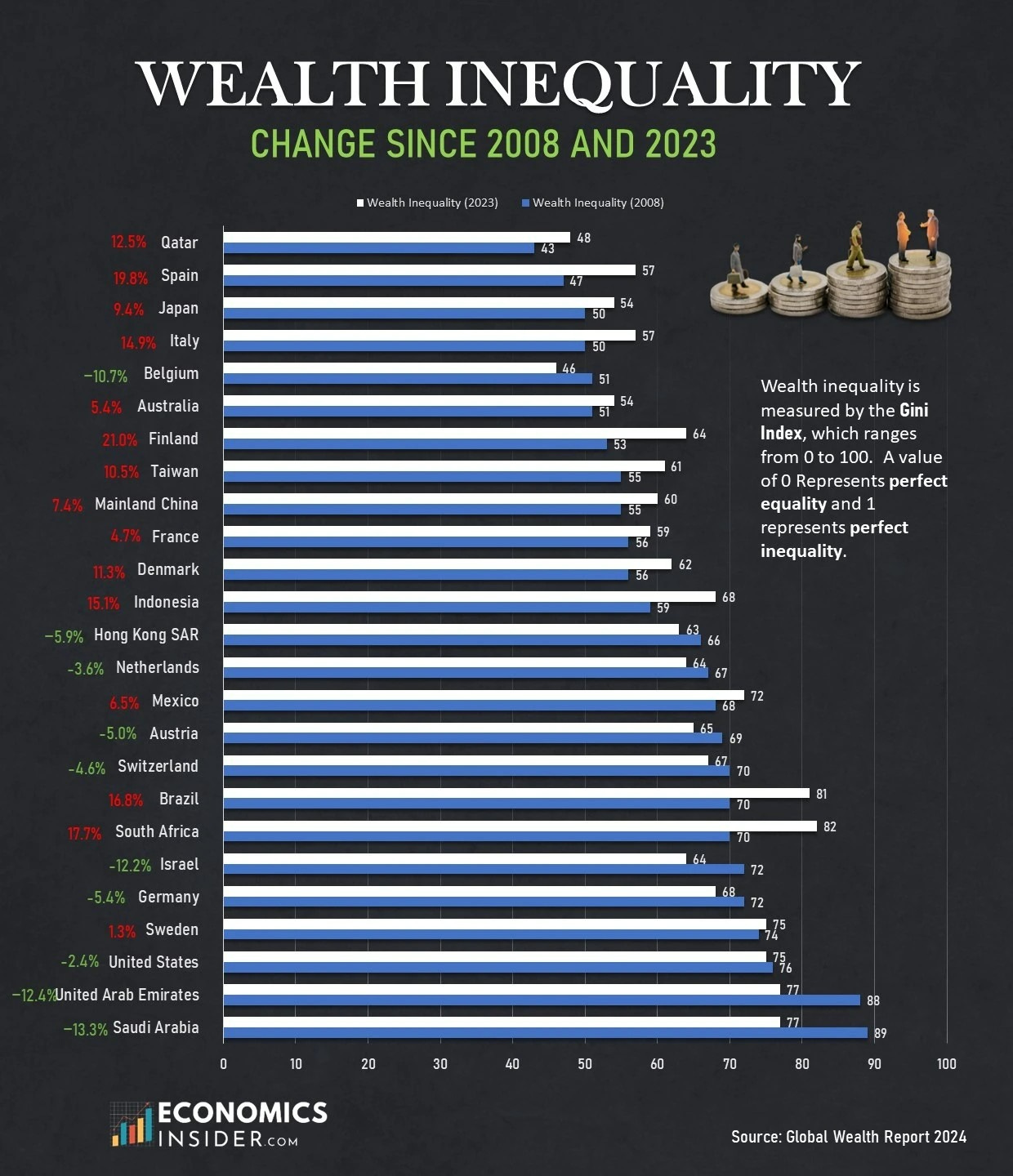

Check out this graphic for Economicinsider.com. It shows that wealth inequality as measured by the GINI coefficient has gotten worse in many countries from 2008 to 2023. The Gini coefficient in the United States, where I am, stayed about the same. (See the graphic for a tidy explanation of the Gini coefficient).

Also take into account that most adults who vote remember the 2008 crisis. They remember that companies and Wall Street were bailed out, and that no one responsible was punished. They will have little appetite for a repeat of the response to 2008.

So in the next year or so, when the AI bubble bursts, and everything comes crashing down there will be the memory of 2008 when something similar happened and everyone responsible got away with it.

In a recent Financial Stability Report, the Federal Reserve Board in the United States found that the overall sense of financial well-being in the country is lower than pre-pandemic levels. According to the Fed, the financial health indicators that they track show a precarious situation especially for middle-income households who are struggling with day-to-day financial challenges and have little in the way of a financial safety net.

These people will soon be asked to bail out billionaires … again.

What do you think they are going to say?

But are we in a bubble?

If you are a good critical thinker, I think you have probably noticed that I’ve claimed we are in a bubble without showing any evidence yet.

Here is the evidence.

According to a Money.com article from August of this year:

The (S&P 500) index’s price-to-earnings (P/E) ratio — a metric that represents investors’ expectations for a company’s future growth, and how much of a premium they’re willing to pay for every dollar a company earns — is a historically high 29.85, compared to a median of 17.97.

A recent Bank of America survey found that a record-high 91% of respondents think stocks today are overvalued, the highest figure since the bank began the survey in 2001. According to Vanguard, U.S. stocks today are overvalued by nearly 50%.

The S&P 500 index, which is a broad basket of US stocks, is up about 6 percent since August, when this article was written.

According to a recent Business Insider article, financial professionals and economists are coming to a consensus that a bubble is already here, and that it will pop. In the article, Economist Richir Sharma claims that the AI boom shows the classic “four Os” of a bubble: overinvestment, overvaluation, over-ownership, and over leverage (borrowing money to buy even more stocks).

Stocks are valued on the future cash-flows they are expected to brin. For AI, the future revenue just hasn’t materialized, and people are starting to realize that it may never materialize.

According to the economist Sharma, about 60% of growth in the US economy this year has come from AI. That growth is mostly an illusion.

According to Gartner.com, about $1 trillion was spent on AI investment in the US in 2024, about $1.5 trillion will be spent this year, and about $2.0 trillion will be spent next year. And what is the return?

According to Menlo Ventures’ recently published generative AI report, enterprise AI revenue reached $37 billion in 2025.

According to Fortune Magazine, the future revenues of AI investments are not as promising as the hype would suggest. They state that AI would need to generate $2 trillion in annual revenue to sustain current growth. That would mean revenues would have to double each year for the next three years with no impediments to the growth.

The AI industry needs advanced chips whose supply is already strained, a great increase in data centers which are energy hogs that are already pushing up energy prices for those middle-class people who are already stretched to the brink according to the US Federal Reserve.

And for what purpose? AI is promised to make a select few people fabulously wealthy and put millions of people out of jobs.

We all know that is a bad deal.

And when it all comes crashing down we will all be asked to fund a bailout for that bad bet.

If you’re looking for investment advice, I’d say put my money on whoever is making the pitchforks.

You don't have to prove that AI is a bubble--that's widely acknowledged.

But--on the rest...well I have pretty distinct memory of a week in 2008/2009. Congress was considering bailing out all the big banks that had caused the crisis. They voted on it on a Monday, and I called my Congresswoman and said that if they passed this thing, they should expect the pitchforks and tumbrels. I was angry and intemperate, and I know that mine was just one of millions of calls from across the political spectrum. Congress voted it down. Then came a full-throated media campaign to persuade us all that if the bailout didn't happen, the economy would collapse and the universe would terminate. Friday they voted on the bill again, and passed it. And we DIDN'T surround the capital with pitchforks--which was a mistake. Since then things have gotten worse for most people--I am skeptical of that graph--you might think this time we'll go string up the culprits--but progress has been made since 2008 in dividing us into two camps blaming each other for everything. I've read that the idea is that when the bubble burst, a winner of the AI race will emerge, and they're wasting all this capital (of many kinds) in the hopes of being the last one standing, who gets the eventual riches. But in any case, I expect the bubble bursting could save us from many of these data centers, but they will, even if at taxpayer expense, build the panopticon so they can collate all the info they have on each of us, figure out who the potential leaders are, and if there IS an uprising, they can crush it, just take us out with drones--concern for legality is already pretty much gone, they're hardly going through the pretense. The fakery and fuckery has eroded Trump's base significantly and that will probably continue, but history shows a solid base of 30% supporting fascism is enough.

But…but…this time it’s different.

(It’s the popping of the hydrocarbon bubble that keeps me up at night.)