Does Finance Need a Hippocratic Oath?

Don't over think it.

But before we get into that, you should realize that what you probably think of as the Hippocratic Oath, is not the Hippocratic Oath. When I got the idea for this essay, I was thinking of the phrase most of us probably associate with the Hippocratic Oath:

“First, do no harm.”

That is not the Hippocratic oath. Those words don’t appear in the oath. The original version of the oath from the 5th century BC does not contain that language, nor does the modern version.

However, the “first do no harm,” ethic is a powerful one, and one most people understand. The phrase is often attached to the healthcare and medical professions but would be welcome in many other, if not all professions.

What harm does finance do?

The job of finance is “the efficient allocation of capital” so that our economies run efficiently. An economy might not run efficiently if capital isn’t allocated to where it needs to go.

According to the recent report, Banking on Climate Chaos 2023, over the past 7 years the world’s biggest banks provided over $5.5 trillion in financing for the fossil fuel industry. The pace is slowing, but just a bit. The funding of the fossil fuel sector dropped from $800.9 billion in 2021 to $668.6 billion in 2022.

Similar reporting reveals the global allocation of funds to the beef and dairy industries. The provocatively titled, Still Butchering the Planet, report examines banks and financial institutions financing livestock companies. The report shows that:

Since the Paris Agreement was signed in 2015, over half a trillion dollars in credit has been provided to the world’s largest 55 industrial livestock companies. This averages out to about $76.9 billion per year.

The funding of the fossil fuel and beef industries are just two examples of the financial industry funding activities that ultimately harm us.

Fossil fuels are a main driver of climate change, as they put CO2 in the atmosphere when burned. The beef and dairy industries contribute to deforestation, water depletion, water pollution through fertilizer and cow waste runoff, and global warming from methane emissions from cows.

We shouldn’t expect the whole world to stop eating beef, but it has an outsized negative impact on our environment. In the United States, beef and dairy cattle are responsible for about 42% of the land use in the lower 48 states.

Source Bloomberg BNF

Deforestation of the Amazon rainforest is mostly due to beef production. Beef is a highly inefficient source of protein when you factor in all the environmental damage. If a significant portion of the land now used to cultivate beef and dairy cattle were used to provide ecosystem services that help heal the planet, we would all be better off.

Source: Environmath.org

Finance is how you get growth.

Finance does the damage it does because finance creates growth. Growth requires building things and investing in new products and services. The money to help these companies grow must come from somewhere. Funding can come from governments or private savings, but to grow things – to reach economies of scale so that shareholders can ultimately profit, you need finance.

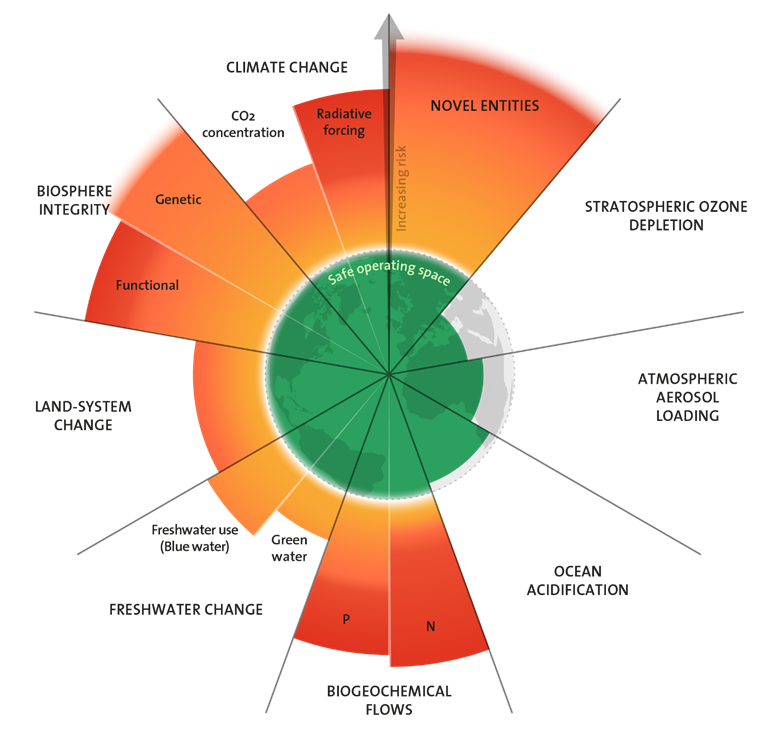

Since the Industrial Revolution, finance has provided the rocket fuel that allowed our global economy to grow. That in and of itself is not bad. But we have reached the point where we have too much of a good thing. With six of nine planetary boundaries currently in the danger zone, and ocean acidification likely to join that group soon, it may be time for a rethink of the place of finance in our society.

Source: Stockholm Resilience Center

What would “do no harm” in finance even look like?

Finance in a world not focused on economic growth would look much different.

To start, there is a finance-adjacent Hippocratic Oath already, it is called the Financial Modeler’s Manifesto. The manifesto came in the wake of the 2008 financial crisis and reflects a “do no harm” ethic for financial modelers.

You can also find a Hippocratic Oath-type statement from some financial advisors who vow to not harm their client's portfolios. That is a nice sentiment, but often more of a marketing gimmick than a promise with impact. The Netherlands requires financial professionals to follow a Banker’s Oath. In a large-scale study, professional auditors confronted 201 Dutch financial advisers with a conflict of interest. They found that when auditors apply a nudge that directly refers to the banker’s oath, advisers are less likely to prioritize the bank’s interests over those of the client. The study found that Dutch regulators expect stronger effects of the oath than observed. So, a good start by the Dutch, but such an oath needs to permeate all of finance.

Like the medical profession, finance is full of professionals with vastly different job descriptions. Much as a Hippocratic Oath in medicine applies equally to a pediatric oncologist as to a podiatrist; a financial Hippocratic oath would apply to financial professionals no matter their title or pay grade.

When I stated that the purpose of finance is the efficient allocation of capital, I didn’t get that from any natural finance law. I learned it in my finance textbooks years ago.

But it makes a certain sense. Finance makes the world work. Getting things done often takes money and that takes finance.

But finance should consider whether a thing should be done, not just if it can be done.

A Hippocratic Oath for Finance would have to expand the understanding of “efficient” in the “efficient allocation of capital” statement. If finance was to hold “efficiency” to mean an activity that not only gets something done, but does so with little harm to humanity, we would have a good starting point.

Here is what a simple Hippocratic Oath for finance could look like:

The purpose of finance is to efficiently allocate capital in the economy for the betterment of society and the people that make up that society.

Finance should not facilitate something simply because it can be done but should consider whether that thing should be done.

If an activity on balance harms society, it should not be financed.

Some people may say that such ethics in finance are unworkable. They may challenge that industries like weapons manufacturing, tobacco, alcohol, oil and gas, chemicals, plastics, mining, and others may harm the environment, but are an essential part of our economy.

People may say, “Who gets to decide whether an activity harms society?”

That is a fair question and one that should be discussed. A Hippocratic Oath for finance would foster more of those discussions. Today, those discussions largely do not happen. Something is financed if a regulator allows it. Regulators allow things based on their knowledge of a market, but also if they are heavily lobbied by industry interest groups.

The medical profession has a Hippocratic Oath and there are still unethical doctors and medical practices that are unfair to patients and exploit those seeking care.

That is not an excuse for not working for something better.

When you make a vow to “do no harm,” to you your patient or client, they will inevitably ask what that means.

Which is the whole point.

No, it needs burning down.

Thanks for paying attention to the damage done by the livestock industry. Alas, the predominant attitude among most degrowth advocates is to bypass this issue. A shift towards veganism is a natural consequence of degrowth, yet for many (perhaps most) degrowth activists, it is not part of the degrowth agenda. I think they're afraid of offending the farmers.